Blockchain Analytics for transaction, wallet and cluster monitoring for crypto assets.

Lukka Blockchain Analytics is a web-based Software as a Service (SaaS) product that analyzes your business’s on-chain data in order to support:

1,618,000+

Crypto Assets

an industry leading 98% of the marke

40,000+

Blockchain entities actively monitored

80+

Blockchain Protocols

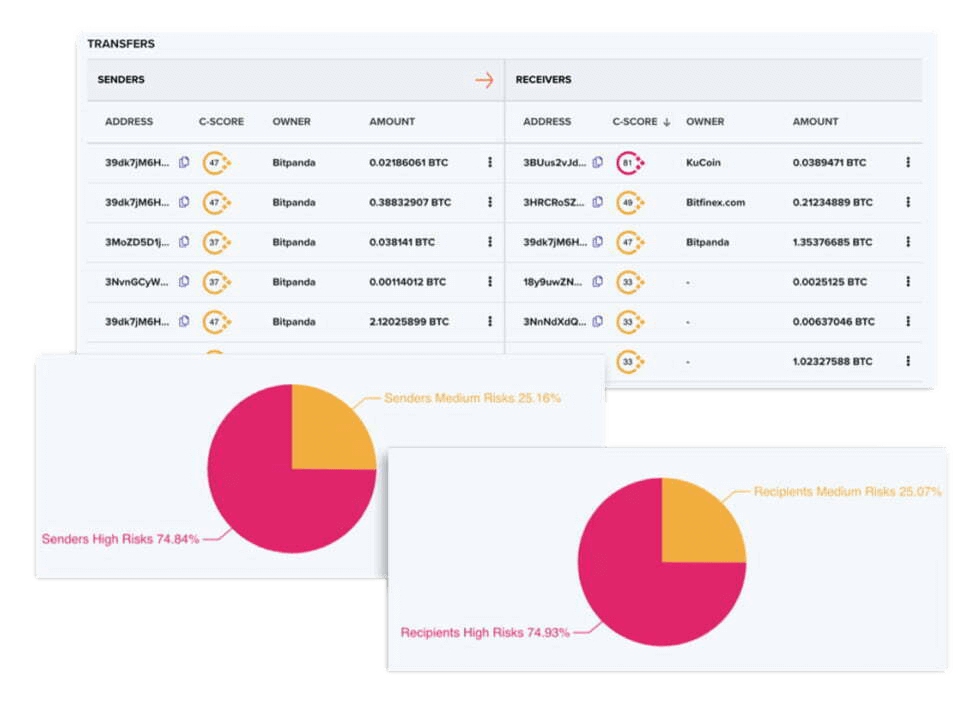

Utilize comprehensive features to support your on-chain analytics, monitoring risk reporting and case management, and more.

Analyze your digital asset wallets and transactions to identify unknown counterparties and transactional patterns.

Get alerts and reports on changes in behaviour and risk rating on thousands of wallets in real-time.

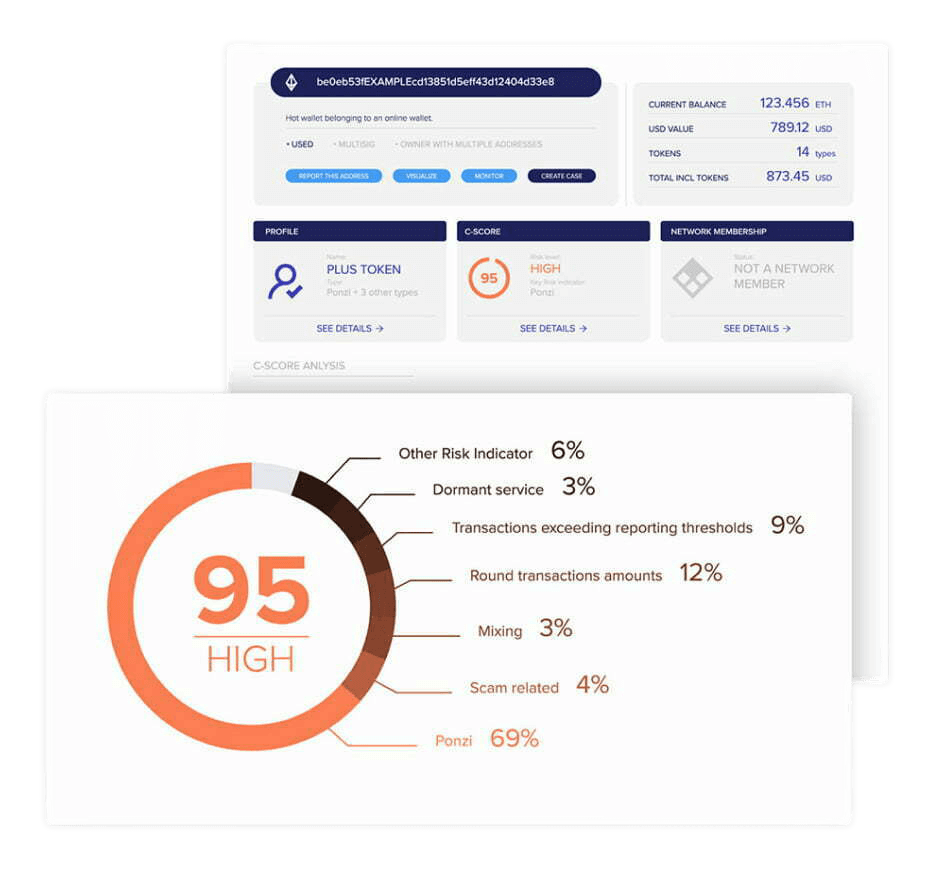

Investigate and assess address risk exposure to various risks such as sanctions, money laundering, or terrorism financing in seconds using Lukka’s market-leading risk assessment model.

Sanctions Screening

The blacklisting tool allows users to cross-check addresses against OFAC, HMT and the EU’s sanctions lists to verify whether they belong to or are related to sanctioned subjects.

80+ Blockchain Protocols

Among them:

Speak with one of our data experts and unlock the full potential of your crypto business.

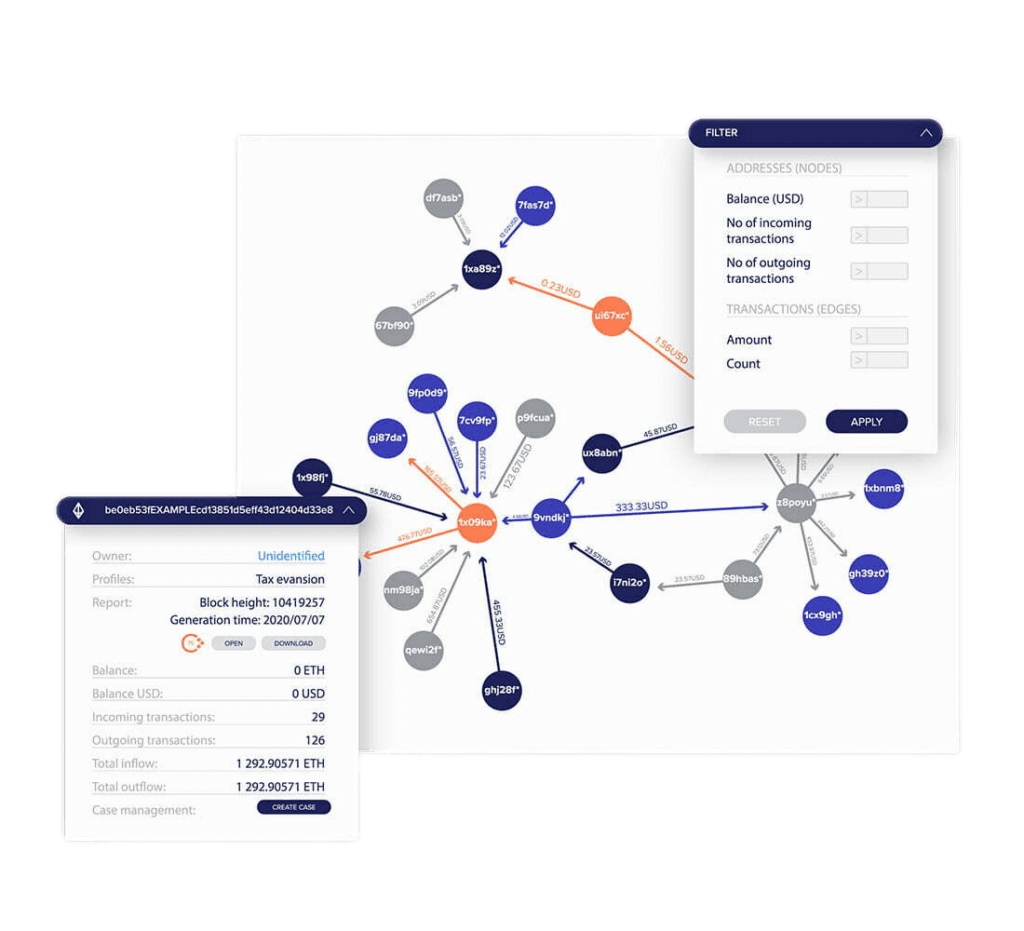

Investigate the transaction history of any supported blockchain address. Simply enter the address, transactions or entity to unveil its connections, transactions, risk exposure and more. Observe the aggregated flow of funds or dig deeper to pinpoint specific transfers, connecting real-world entities to the blockchain ecosystem.

Blockchain Analytics excels in tracking funds across hundreds of consecutive transactions, offering a comprehensive view of funds' flow. Assess the AML risks of counterparty addresses with precision, ensuring compliance and security.

Get detailed information about legal entities operating in the blockchain ecosystem, predominantly virtual asset service providers (VASPs) such as cryptocurrency exchanges.

AML Risk Reports for Full Compliance

Investigate and assess address risk exposure to various risks such as sanctions, money laundering, or terrorism financing in seconds using Lukka’s market-leading risk assessment model.

Liquidity Pool Risk Reports

Comprehensive risk management solution that can analyse any DeFi liquidity pool for a swift, scalable solution. Understand where serious compliance and risk red flags are. For any given liquidity pool - the exposure of high-risk addresses contributing to the pool is analysed with direct and proximity-related risks identified.

Sanction Screening

The blacklisting tool on Lukka Blockchain Analytics (SaaS) allows users to cross-check addresses against OFAC, HMT and the EU’s sanctions lists to verify whether they belong to or are related to sanctioned subjects. 100,000+ addresses are identified as being linked to sanctions.

…and hundreds more businesses.

The term crypto assets refer to a broad new class of assets created through Distributed Ledger Technology (DLT). DLT allows data to be stored in multiple decentralised locations on a common network, enabling participants to track ownership and transfer of virtual assets, such as crypto assets. Virtual assets have unique characteristics, positive and negative, compared to traditional assets and payments. However, questions often arise among those interested in crypto assets regarding transactions – how to track crypto transactions, how to report crypto transactions, or how to trace a crypto transaction. We will clarify these questions and show how to keep track of crypto transactions.

crypto transactions are a confirmed transfer of digital money issued to the network and then stored in the form of blocks. Any user can follow the chain of operations, even from the beginning, i.e., receipt of the first crypto assets. Crypto transactions are carried out between unique wallets. Usually, users buy crypto to make money from exchange rate fluctuations. In addition, they can also use crypto assets to pay for various goods and services online.

When initiating crypto transactions, it is essential to know that no actual transfer of the fiat form of money occurs in the process. Instead, only a typed number of coins are transferred (from one wallet to another), and the transaction information is publicly available in encrypted form.

For this reason, the questions that often arise about how to track crypto transactions, how to see crypto transactions, or how to trace a crypto transaction should be focused on finding the right software to accomplish such tasks. This is because it will make it possible to efficiently manage your portfolio and reap the maximum benefits from crypto investments.

There are different ways to track crypto transactions. Among these, the key ones are:

If you are wondering how to track a crypto transaction, you can use a blockchain explorer. Those systems are dedicated to monitoring transactions in specific blockchains. How do they work? Enter a wallet’s public address or transaction identifier (TXID) into the search field to see transaction details such as amount, time, sender and recipient addresses, and confirmations.

If you use a crypto wallet app like Exodus, Ledger Live, or Trust Wallet, you can track your transactions right there. In the majority of cases, they let you simply track your financial transactions and view the whole history inside the app.

Technological innovations, including crypto transaction tracking software, also help answer the question of how to trace a crypto transaction. Thanks to them, it is possible to track assets in real-time, which translates into greater profits from crypto assets as well as an increased level of security.

Options to set up email or SMS notifications of completed transactions are available on several crypto exchanges and wallets. You can configure these alerts to get real-time data regarding transactions.

It is essential to be careful and maintain the privacy of your data when tracking crypto transactions. Ensure you use trusted sources and do not share your private keys or other sensitive information with unauthorised parties.

The answer to this question may seem straightforward at first glance – yes, crypto transactions are traceable.

However, here comes the twist – the anonymity of crypto transactions is not as simple as it seems. While the wallet addresses used in transactions are often pseudonymous, concealing the real-world identities of their owners, the flow of funds can still be analyzed to potentially link transactions to specific individuals or organizations. This is where the puzzle of traceability gets more perplexing.

So if future dilemmas arise again, are crypto transactions traceable, it is crucial to be aware of your privacy and manage your digital currency transactions carefully.

Due to the high levels of security offered by blockchain technology, crypto transactions are typically regarded as secure. These include functioning in a decentralized environment, encrypting data with the use of sophisticated cryptographic algorithms, or verifying data via a node-based network of computers.

However, it is worth remembering that the security of crypto transactions can be compromised by inadequate management of private keys, carelessness in the use of crypto wallets, hacking attacks, forgery, or other types of fraud. Therefore, taking appropriate precautions, such as using secure wallets, storing private keys offline, avoiding suspicious websites, and avoiding sharing your confidential information, is crucial.

If unauthorised asset flows are detected, on the other hand, it is worth knowing how to report crypto transactions to take timely preventive action.

If you are wondering how to track crypto transactions, it is essential to understand that most crypto assets are built on a decentralised blockchain network that provides transparent and traceable transaction data. If you additively want to know how to see crypto transactions, one way to do so is by using a blockchain explorer, a tool that allows you to search and view details of individual transactions. Conversely, if you are troubled by how to report crypto transactions or suspect any fraudulent or suspicious activity, you may need to report crypto transactions to the relevant authorities, such as law enforcement or financial regulators, who can investigate and take appropriate action. It is crucial in this context to follow local laws and procedures for accurate reporting of crypto transactions. Indeed, there is now growing pressure from governments and regulators to identify and monitor suspicious crypto transactions to combat financial crime, such as money laundering or terrorist financing.

Money laundering is seen as one of the critical risks in the crypto market. By design, anonymous and difficult-to-track crypto market transactions encourage financial crimes and can be used to launder illegally earned income. In the article below, we discuss crypto money laundering statistics. How are cryptos used in financial crimes? How can they be prevented?

Before we look at the crypto money laundering statistics, let’s explain what this illegal practice actually consists of. According to the accepted definition, it is a process in which the origin of illegal funds is concealed by introducing them into legitimate economic circulation. Money laundering became a common way to avoid responsibility for illegal transactions in the 1980s, with the rise of organized crime. For example, money laundering allows drug traffickers, tax evaders, human traffickers, or terrorist organizations to hide their income and remove themselves from legal responsibility.

With the emergence of Bitcoin, crypto assets have been seen as a potential tool for fraud. Skeptics point out that in the hands of cybercriminals, digital assets are an easy way to launder funds. To some extent, anonymous, easy to transfer, and with a global reach – crypto assets, due to their characteristics, can be used to put illicit money into circulation. In this regard, several crypto money laundering techniques can be distinguished. Statistics show that the most common way to hide illegal funds is using so-called mixers, by which transactions on the blockchain are mixed. As a result, tracking them and thus detecting irregularities is much more difficult. The scale of crime in the crypto world is increasing year on year. In 2022, the value of crypto-assets stolen through various crimes increased by 51% over the previous year, reaching a value of more than $3.5bn. Let’s look at a few events from this period for a better understanding of the scale of this problem.

One of the most popular games built on the blockchain- Axie Infinity, experienced a hack in March 2022. Funds of 173,600 ETH and 25.5 million USDC tokens were taken from its bridge service- Ronin Bridge; connecting the original blockchain with Ethereum; with a total value of $612m USD.

In February 2022, a hacker manipulated Wormhole, Solana’s bridge, to credit 120k ETH on Ethereum. This allowed them to mint the equivalent amount of wrapped whETH (Wormhole ETH) on Solana. Total value of the hack is estimated at $312 million.

August 2022: Nomad Bridge- a decentralized protocol that enables users to transfer their crypto assets between different blockchains, including Avalanche (AVAX), Ethereum (ETH), Evmos (EVMOS), and Moonbeam (GLMR). An attacker and copycats were able to exploit a bug in the Nomad bridge contract and withdraw over $190 million worth of crypto from the platform.

Not since today have crypto assets stirred up considerable controversy. Illegal activities are facilitated by the digital form and decentralized nature of crypto assets, which can contribute to their use by criminals.

Detailed crypt money laundering statistics are difficult to provide – many procedures have not been detected. At the same time, it should be emphasized that it is still cash, not crypto assets, that is the primary tool used to purify dirty money.

Crypto money laundering statistics reflect negatively on their perception and further adoption. Governments around the world are focusing on combating crypto money laundering. Increasing attention is being paid to tracking the flow of funds and identifying suspicious transactions. In addition, data analytics tools are helping to identify behavior indicative of money laundering. As a result, crypto money laundering statistics can be expected to decline in the coming years.

The risks associated with the possibility of money laundering via crypto assets are one of the arguments for comprehensive regulation. The proliferation of AML regulations implemented by more countries, as well as the obligation to conduct KYC, contribute to blocking potential money laundering attempts. With the regulation of the crypto market, it can be expected that the fight against money laundering in this rapidly growing sector will become more and more effective.

Illegal activities can also be prevented through close cooperation between market players, especially regulators and crypto exchanges, and with the help of improvements such as AML platform. In doing so, it is necessary to exchange information between them, allowing for easier detection of financial crimes linked to crypto assets. Undoubtedly, an effective fight against money laundering through crypto assets will play a vital role in the sector’s further development.

The development of new technologies and the significant adaptation of the digital world encourage the emergence of previously unknown forms of crime – including in the crypto market. In addition, the tightening of AML regulations is causing criminals to explore new areas that are not yet adequately regulated and secured to achieve their goals. If you are an active participant in the crypto market, then be sure to read this article. From it, you will learn what crypto AML red flags are, AML red flags indicators, and how to avoid fraud.

AML, or Anti-Money Laundering, is a procedure to prevent money laundering. Under the AML procedure, financial institutions or other entities in contact with settlements must detect and prevent illegal payment transactions. These measures may include verifying the identity of customers, monitoring transactions, and reporting suspicious activity to the relevant law enforcement authorities. In addition, financial institutions are required to apply internal procedures and employee training on anti-money laundering.

AML (Anti-Money Laundering) red flags are indicators or warning signs suggesting potential money laundering or terrorist financing activities. They are used by financial institutions, such as banks and other money markets or insurance-related entities, to identify suspicious transactions or actions that may violate laws and regulations against illegal financial transactions.

Common examples of AML red flags include:

These primarily refer to transactions that deviate from the previous activity in the account of the client in question, as well as those that are inconsistent with the client’s financial activity.

Deposits or withdrawals of large cash or multiple cash transactions just below the reporting threshold are also good examples of AML red flags.

Some of the transactions performed by senders and recipients on crypto exchanges may indicate attempted money laundering. Such red flags include users who often try to open an account using the same IP address or attempt to change personal IPs and other contact details such as email or private information.

Transactions entered into countries commonly known for high financial crime, money laundering, corruption, or terrorist financing are also on the red flags in transaction monitoring list.

Another example of AML red flags is transactions involving funds from unknown or unexplained sources or funds inconsistent with the client’s known financial profile.

It should be noted that one or more red flags in transaction monitoring do not necessarily mean that money laundering or terrorist financing is taking place. These situations can also be linked to cyber-attacks or some other form of phishing attempt. Whatever their nature, however, they may warrant further investigation and report to the relevant authorities as part of the financial institution’s AML compliance obligations.

Crypto AML red flags are also indicators that provide information about potentially suspicious crypto activities. In addition, these crypto red flags serve as warning signs indicating criminal activity, including money laundering or other illegal activities.

Digital currency exchanges and other virtual asset service providers (VASPs) can gather crucial data and gain insight into potential risks and vulnerabilities in their systems by discovering and analysing crypto AML red flags. This way, crypto red flags can provide valuable information and help to detect potentially suspicious activity and indicate where action needs to be taken, such as conducting further investigation, reporting to the relevant authorities, or implementing enhanced due diligence measures.

By understanding the importance of transaction monitoring red flags and AML red flags indicators and how they may be linked to money laundering or other illegal activities, the crypto market can dramatically strengthen its AML compliance efforts and reduce the risk of being used as a conduit for illegal activities involving crypto assets.

Although the crypto market shows a high level of transaction security thanks to blockchain technology, with the growing popularity of this sector, more and more cases of illegal activities are emerging. To avoid these, it is worth opting for crypto AML software, which ensures compliance with regulations and, at the same time, counteracts money laundering. With its help, you can gain an in-depth understanding of the market situation in just a few seconds with risk checks and data points, ranging from financial crime to counterparty identity. In addition, transactions and addresses recorded on a blockchain with multiple inputs and outputs can be easily monitored, significantly increasing security. Just as importantly, this type of software sends alerts on high-risk crypto wallets and provides the ability to monitor transactions in real-time to perform efficient due diligence checks for compliance.